by Ryan Gawn | Nov 8, 2015 | Cooperation and coherence, Global system, Influence and networks, UK

This is the third in a series of blogs on the upcoming Spending Review, and how Britain maximises its influence and soft power across the world at a time of declining budgets. This focuses on the BBC World Service, “Britain’s gift to the world”. Find the others with the following links: FCO, British Council.

Other UK soft power assets fall into the “unprotected” category and are at risk of cuts. Since the Chatham House / YouGov Survey began polling in 2010, BBC World Service radio and TV broadcasting has been seen by UK opinion-formers as the UK’s top foreign policy tool, consistently ranking higher than all other foreign policy “assets”.

Broadcasting to 210m people every week and with a budget less than half that of BBC2, the World Service faces increasing challenges in the form of domestic and international competition, technical change, and a legacy of underinvestment. FCO funding was cut by 16% in 2010, leading to the departure of about a fifth of  its staff. This has had an impact – in 2005 the organisation provided services in 43 languages, now down to 28. In contrast, there is increased competition – following a 2007 directive from Premier Hu Jintao, China has been investing heavily in soft power assets with state journalists now pumping out content in more than 60 languages. Lacking first mover advantage, it is clear that competitors have strategic ambitions. Yu-Shan Wu of the South African Institute for International Affairs comments, “Since the Beijing Olympics, we have seen increased efforts to provide China’s perspective on global affairs, signalling relations with Africa have moved beyond infrastructure development to include a broadcasting and a people-to-people element. There are now regular exchanges between Chinese and African journalists, and it is clear that China is stepping up and laying the foundations for a more concerted public diplomacy effort in the region.”

its staff. This has had an impact – in 2005 the organisation provided services in 43 languages, now down to 28. In contrast, there is increased competition – following a 2007 directive from Premier Hu Jintao, China has been investing heavily in soft power assets with state journalists now pumping out content in more than 60 languages. Lacking first mover advantage, it is clear that competitors have strategic ambitions. Yu-Shan Wu of the South African Institute for International Affairs comments, “Since the Beijing Olympics, we have seen increased efforts to provide China’s perspective on global affairs, signalling relations with Africa have moved beyond infrastructure development to include a broadcasting and a people-to-people element. There are now regular exchanges between Chinese and African journalists, and it is clear that China is stepping up and laying the foundations for a more concerted public diplomacy effort in the region.”

From April last year, the World Service ceased to be funded by the FCO, and is now resourced by a share of the BBC licence fee. Although its budget was increased by the BBC in 2014 (up by £6.5m to £245m), the BBC itself faces many of its own funding challenges. In July, the Chancellor called on the organisation to make savings and make ‘a contribution’ to the budget cuts Britain is facing. Ministers asked the BBC to shoulder the £750m burden of paying free licence fees for the over-75s, and later that month unveiled a green paper on the future of the broadcaster which questioned if it should continue to be “all things to all people”. In the same month, the organisation announced that 1,000 jobs would go to cover a £150m shortfall in frozen licence fee income.

The World Service is somewhat insulated from wider BBC cuts, as the BBC has to seek the Foreign Secretary’s approval to close an existing language service (or launch a new one). Nevertheless, in early September, Director-Genera l Tony Hall made the first of a series of responses to the green paper. Making a “passionate defence of the important role the BBC plays at home and abroad”, he unveiled proposals for a significant expansion of the World Service, including; a satellite TV service or YouTube channel for Russian speakers, a daily news programme on shortwave for North Korea, expansion of the BBC Arabic Service (with increased MENA coverage), and increased digital and mobile offerings for Indian and Nigerian markets. Interestingly, the proposals sought financial support from the government, suggesting matched funding, conditional upon increased commercialisation of the BBC’s Global News operation outside the UK.

l Tony Hall made the first of a series of responses to the green paper. Making a “passionate defence of the important role the BBC plays at home and abroad”, he unveiled proposals for a significant expansion of the World Service, including; a satellite TV service or YouTube channel for Russian speakers, a daily news programme on shortwave for North Korea, expansion of the BBC Arabic Service (with increased MENA coverage), and increased digital and mobile offerings for Indian and Nigerian markets. Interestingly, the proposals sought financial support from the government, suggesting matched funding, conditional upon increased commercialisation of the BBC’s Global News operation outside the UK.

More on the expansion plans here.

by David Steven | Jan 10, 2011 | Influence and networks

I am hugely reassured to hear that, in this era of global crisis, British diplomats are focusing on the really important issues:

An agreement has been signed to bring two giant pandas to Edinburgh Zoo, the first to live in the UK for 17 years.

The deal was signed at Lancaster House in London by the Royal Zoological Society of Scotland and the Chinese Wildlife Conservation Association.

It was witnessed by Deputy Prime Minister Nick Clegg and Vice Premier of China Li Keqiang.

Tian Tian and Yangguang, a breeding pair born in 2003, will be under the custodianship of the zoo society.

The project represents the culmination of five years of political and diplomatic negotiation at the highest level and it is anticipated the giant pandas will arrive in their new home as soon as a date is agreed.

The Chinese government is said to charge around $2m a year to rent a pair of pandas. Apparently though, “the Giant Panda Project will be funded through sponsorship, offering unparalleled opportunities in terms of international corporate, commercial and diplomatic relationships between China and the UK.”

Happy days.

by David Steven | Oct 20, 2010 | UK

I know Treasury mandarins don’t laugh much, but I suspect a few of them will be smirking on their way home tonight. If I read the spending review right, they’ve pulled a fast one on their bitter, and less numerate, rivals at the Foreign Office – something that is sure to cause an immense feeling of satisfaction.

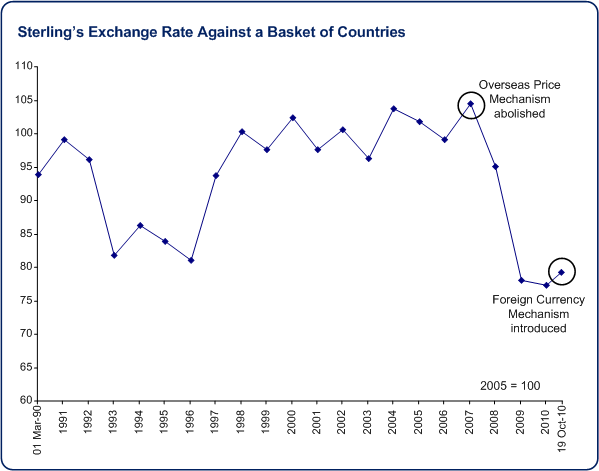

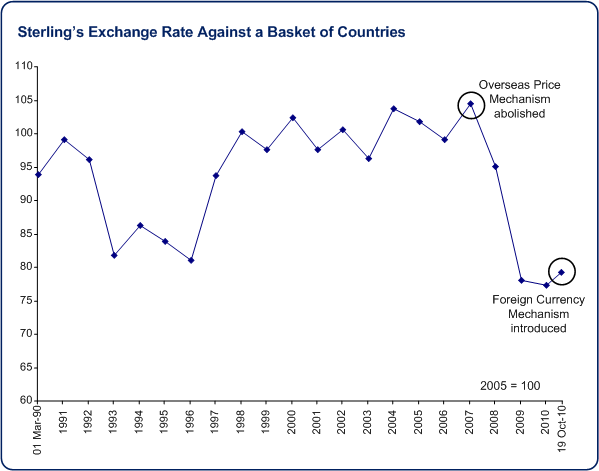

The crux of the matter is in who bears the risk of currency fluctuations. The FCO spends most of its money overseas, so its costs rise when the pound is weak, fall when it is strong.

Historically, the Treasury has evened this out through the Overseas Price Mechanism. The FCO was given money in sterling and, if it found that this was worth more than expected overseas, it gave money back to the Chancellor. If the settlement was worth less than expected, it was given sufficient extra funds to enable planned activity.

In the mid 2000s, the tide was in the Treasury’s favour, with £5-14 million a year being returned by the FCO, but in 2007/08, the pound began to weaken and HMT had to pay the FCO £1.5 million or so.

The Treasury didn’t like this, so it abolished the price mechanism and left the FCO to deal with an increasingly feeble pound. The result was carnage. The FCO lost £100m in 2008/09 and the same again in 2009/10.

According to the Foreign Affairs Select Committee:

The FCO has lost around 13% of the purchasing power of its core 2009–10 budget as a consequence of the fall of Sterling. We concur with the National Audit Office, that the withdrawal of the Overseas Price Mechanism and the subsequent fall of Sterling have had “a major impact on the FCO’s business worldwide”.

We note that the budgetary transfers which the FCO has made to try to help cope with the hit have absorbed all of the Department’s contingency reserve at the Treasury in both 2008–09 and 2009–10, and we conclude that this represents an unacceptable risk to the FCO’s ability to perform its functions.

So today’s announcement that currency risk is being passed back to the Treasury is a big coup, no? Certainly, the new ‘Foreign Currency Mechanism’ will give greater certainty to FCO staff, but the re-introduction comes at a time that is highly disadvantageous to our diplomats.

Look at this graph showing the pound’s value against a basket of currencies. Currency risk was dumped on the FCO just as the pound was about to begin a long, hard fall. It’s now been taken back by HMT at what looks like the currency’s trough.

Worst case for HMT, the pound’ll bump along the bottom. Best case, it’ll strengthen and they can demand a big fat cheque from William Hague. It’s the first rule of markets – sell high, buy low – especially when you want to turn the screw on your next-door neighbours.

by Alex Evans | Jun 2, 2010 | Cooperation and coherence, Global Dashboard, UK

Today sees the publication of Organizing for Influence: UK Foreign Policy in An Age of Uncertainty (pdf), a new report authored by David and me, published by the Royal Institute of International Affairs. This is one of the first two publications from Chatham House’s project on rethinking Britain’s overall foreign policy role; the other, also out today, is a scene-setter by Chatham House’s director Robin Niblett. (Still to come are in-depth papers on Britain and… the global economy; the US and Europe; the rising powers; energy and climate; the developing world; and security and defence.)

In our report, we observe that while foreign policy and global issues barely got a mention during the general election campaign, it’s a racing certainty that the new coalition won’t have the luxury of ignoring them in government. As we’ve argued before, globalization is in the midst of what we term a ‘long crisis’. As an open economy and society, Britain is especially exposed. The government’s international workload is about to increase, perhaps dramatically. And given the need to reduce the deficit, it’s going to find itself stretched to the limit.

All this means, we think, that the government needs to work to upgrade and reform all aspects of its international programme. For one thing, that means making clear strategic choices – specifically, we think, seeing Britain’s international agenda through three overlapping lenses:

– First, national security. For us, this is about the direct threats to Britain, within a relatively short timescale – 5-10 years or so. It should not be about the longer-term or non-security risks like climate, scarcity or global economic risks. While we very much welcome the coalition’s creation of a National Security Council and appointment of the UK’s first National Security Adviser, we argue that if it tries to cover the whole of foreign policy, then we’ll be back to a storyline we know all too well: the urgent crowds out the essential, and preventive action gives way to fire-fighting.

– Second, global risks and the global system. We have to look at these issues separately from national security, we argue. For one thing, the amount of risk that’s tolerable in each is totally different. Any failure on the national security front can be disastrous. On global system issues, on the other hand, you have to take risks if you want to get anywhere – to be a venture capitalist, not a bank manager.

– Finally, fragile states. National security is fine as a lens when you’re looking at countries where the UK actually has troops deployed, like Afghanistan. But it’s the wrong lens for looking at places like Nigeria – where the challenge has much more to do with taking a long-term, political economy based approach to questions of governance, resilience and ‘development diplomacy’.

What does all this mean in practice?

A dramatic overhaul of the Foreign Office’s London HQ, for one thing – turning it into something that looks a lot more like the Cabinet Office (with at least half of senior policy posts filled from other government departments, and a lot more recruitment from outside government too), so that it can finally be the department for global issues that it should have become years ago.

A much tighter focus on fragile states at DFID, too – which we argue should close down its offices in ‘good-performing’ countries like Tanzania in favour of putting its aid through partnerships with other donors, or the multilateral system, and focusing its staff much more heavily on the really difficult cases. It’s staff, not cash, that’s DFID’s scarcest resource, so that’s what it needs to prioritise. (Did you know that DFID has only 2,586 people – to the Foreign Office’s 14,549?)

Plus a bunch more recommendations besides – including more ambassadors for issues (like we already have on climate and arms control), a tighter focus on the alliances and networks that could really magnify UK influence (especially the EU, G20 and NATO), a much bigger role for Parliament in foreign policy, and – perhaps the farthest reaching change of all – allocating budgets to strategies rather than departments, on the basis of first-principles reviews of UK objectives, capabilities and performance on the 3 areas of national security, global systems and fragile states.

Read the whole thing – all comments, as ever, very welcome. We’re also doing an event on the report at Chatham House on 9 June, and will be running the concluding session of the Institute’s two day conference on Britain’s future foreign policy role on 13 and 14 July.

its staff. This has had an impact – in 2005 the organisation provided services in 43 languages, now down to 28. In contrast, there is increased competition – following a 2007 directive from Premier Hu Jintao, China has been investing heavily in soft power assets with state journalists now pumping out content in more than 60 languages. Lacking first mover advantage, it is clear that competitors have strategic ambitions. Yu-Shan Wu of the South African Institute for International Affairs comments, “Since the Beijing Olympics, we have seen increased efforts to provide China’s perspective on global affairs, signalling relations with Africa have moved beyond infrastructure development to include a broadcasting and a people-to-people element. There are now regular exchanges between Chinese and African journalists, and it is clear that China is stepping up and laying the foundations for a more concerted public diplomacy effort in the region.”

its staff. This has had an impact – in 2005 the organisation provided services in 43 languages, now down to 28. In contrast, there is increased competition – following a 2007 directive from Premier Hu Jintao, China has been investing heavily in soft power assets with state journalists now pumping out content in more than 60 languages. Lacking first mover advantage, it is clear that competitors have strategic ambitions. Yu-Shan Wu of the South African Institute for International Affairs comments, “Since the Beijing Olympics, we have seen increased efforts to provide China’s perspective on global affairs, signalling relations with Africa have moved beyond infrastructure development to include a broadcasting and a people-to-people element. There are now regular exchanges between Chinese and African journalists, and it is clear that China is stepping up and laying the foundations for a more concerted public diplomacy effort in the region.” l Tony Hall made the first of a series of responses to the green paper. Making a “passionate defence of the important role the BBC plays at home and abroad”, he unveiled proposals for a significant expansion of the World Service, including; a satellite TV service or YouTube channel for Russian speakers, a daily news programme on shortwave for North Korea, expansion of the BBC Arabic Service (with increased MENA coverage), and increased digital and mobile offerings for Indian and Nigerian markets. Interestingly, the proposals sought financial support from the government, suggesting matched funding, conditional upon increased commercialisation of the BBC’s Global News operation outside the UK.

l Tony Hall made the first of a series of responses to the green paper. Making a “passionate defence of the important role the BBC plays at home and abroad”, he unveiled proposals for a significant expansion of the World Service, including; a satellite TV service or YouTube channel for Russian speakers, a daily news programme on shortwave for North Korea, expansion of the BBC Arabic Service (with increased MENA coverage), and increased digital and mobile offerings for Indian and Nigerian markets. Interestingly, the proposals sought financial support from the government, suggesting matched funding, conditional upon increased commercialisation of the BBC’s Global News operation outside the UK.