I know Treasury mandarins don’t laugh much, but I suspect a few of them will be smirking on their way home tonight. If I read the spending review right, they’ve pulled a fast one on their bitter, and less numerate, rivals at the Foreign Office – something that is sure to cause an immense feeling of satisfaction.

The crux of the matter is in who bears the risk of currency fluctuations. The FCO spends most of its money overseas, so its costs rise when the pound is weak, fall when it is strong.

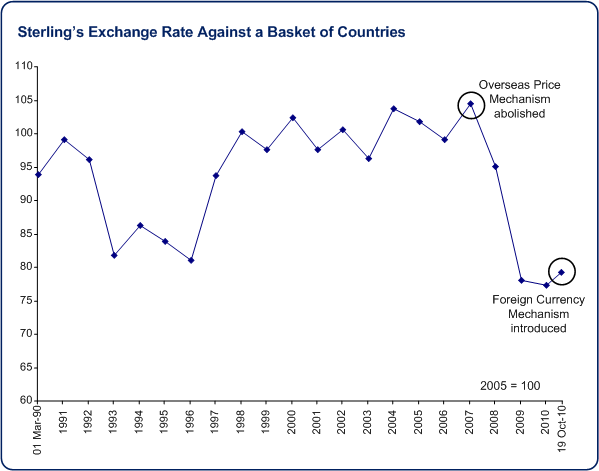

Historically, the Treasury has evened this out through the Overseas Price Mechanism. The FCO was given money in sterling and, if it found that this was worth more than expected overseas, it gave money back to the Chancellor. If the settlement was worth less than expected, it was given sufficient extra funds to enable planned activity.

In the mid 2000s, the tide was in the Treasury’s favour, with £5-14 million a year being returned by the FCO, but in 2007/08, the pound began to weaken and HMT had to pay the FCO £1.5 million or so.

The Treasury didn’t like this, so it abolished the price mechanism and left the FCO to deal with an increasingly feeble pound. The result was carnage. The FCO lost £100m in 2008/09 and the same again in 2009/10.

According to the Foreign Affairs Select Committee:

The FCO has lost around 13% of the purchasing power of its core 2009–10 budget as a consequence of the fall of Sterling. We concur with the National Audit Office, that the withdrawal of the Overseas Price Mechanism and the subsequent fall of Sterling have had “a major impact on the FCO’s business worldwide”.

We note that the budgetary transfers which the FCO has made to try to help cope with the hit have absorbed all of the Department’s contingency reserve at the Treasury in both 2008–09 and 2009–10, and we conclude that this represents an unacceptable risk to the FCO’s ability to perform its functions.

So today’s announcement that currency risk is being passed back to the Treasury is a big coup, no? Certainly, the new ‘Foreign Currency Mechanism’ will give greater certainty to FCO staff, but the re-introduction comes at a time that is highly disadvantageous to our diplomats.

Look at this graph showing the pound’s value against a basket of currencies. Currency risk was dumped on the FCO just as the pound was about to begin a long, hard fall. It’s now been taken back by HMT at what looks like the currency’s trough.

Worst case for HMT, the pound’ll bump along the bottom. Best case, it’ll strengthen and they can demand a big fat cheque from William Hague. It’s the first rule of markets – sell high, buy low – especially when you want to turn the screw on your next-door neighbours.