by Ryan Gawn | Sep 15, 2016 | Global system, Influence and networks, UK

Guest post by Quintin Oliver, of Stratagem International, @StratagemInt

Hot off the plane from Bogota where he was advising on the upcoming referendum, Quintin Oliver tells us his ten commandments on referendums:

- Referendums are not elections – there are

no candidates and no posts to win, and although parties are involved, they and the voters are addressing an issue; campaigners must ‘unlearn’ their election campaigning instincts. First mover advantage often goes to those who successfully ‘frame’ the terms of debate. Think Brexit, as ‘taking back our country’.

no candidates and no posts to win, and although parties are involved, they and the voters are addressing an issue; campaigners must ‘unlearn’ their election campaigning instincts. First mover advantage often goes to those who successfully ‘frame’ the terms of debate. Think Brexit, as ‘taking back our country’.

- Voters often answer the wrong question (Charles de Gaulle) – referendums are susceptible to ‘capture’ by other players, and voters often use them to register a protest against the government of the day, or against the political elites. Think the Swedish Euro vote of 2003 vote, led by Abba, Volvo and Saab, which was expected to pass.

- Referendums, especially on big national

issues, against a background of conflict, usually become more emotional, than rational; voters express their instincts, rather than their cold, rational, evidence-based selves. They remember the past and are reluctant to embrace an uncertain – or overly idealistic – future. Think Scotland 2014.

issues, against a background of conflict, usually become more emotional, than rational; voters express their instincts, rather than their cold, rational, evidence-based selves. They remember the past and are reluctant to embrace an uncertain – or overly idealistic – future. Think Scotland 2014.

- Most referendums are lost (albeit narrowly) – indicating that promoting the ‘change’ case is harder, especially if complicated, recently published and containing tough concessions, unless there is a huge consensus that the change is overwhelmingly acceptable And much more attractive than now. This is exacerbated mid-term (when governments tend to be less popular) and in tough economic times, when the risks of change may seem higher. Think Cyprus 2004, when the Greek south was entering the EU, regardless.

- Winning a ‘No’ campaign in a referendum is easier – opponents can scatter objections and complaints, untruths and deceptions, with impunity, while the Yes side has to articulate its change proposition lucidly, coherently and cogently; they must not become defensive and bogged down in detail. Think the Alternative Vote debacle of 2011, when a 2:1 polling lead was reversed.

- Referendum debates can be volatile and uncertain – with shifts in opinion and voting intentions as (sometimes unexpected) issues gain prominence and traction. The status quo can become more attractive against a kaleidoscope of untested options, especially if a credible Plan B (renegotiation) is promoted. Think Nice l and Lisbon l in the Republic, both reversed after concessions.

- Referendums allow many more

voices – voters tend to look first to their political party of choice for advice but then seek other cues from voices they trust, or who appear widely to be opinion-formers (churches, labour unions, NGOs, artists, celebrities, athletes…); voters especially like to see traditionally opposing politicians putting aside their differences in the national interest and sharing platforms to promote their unified case, especially if this contrasts with the opponents. Think Good Friday Agreement poll in 1998.

voices – voters tend to look first to their political party of choice for advice but then seek other cues from voices they trust, or who appear widely to be opinion-formers (churches, labour unions, NGOs, artists, celebrities, athletes…); voters especially like to see traditionally opposing politicians putting aside their differences in the national interest and sharing platforms to promote their unified case, especially if this contrasts with the opponents. Think Good Friday Agreement poll in 1998.

- Referendums permit a significant space

to organised civil society (usually excluded from traditional elections) – since it can articulate bottom-up, grassroots depth and richness around the issues for debate, with knowledge and experience, credibility and authenticity. Elections are rarely ‘fun’, but referendums can give expression to creativity, satire, parody and excitement; music and art can capture and shift the national mood. Think the 2015 Equal Marriage plebiscite in Ireland.

to organised civil society (usually excluded from traditional elections) – since it can articulate bottom-up, grassroots depth and richness around the issues for debate, with knowledge and experience, credibility and authenticity. Elections are rarely ‘fun’, but referendums can give expression to creativity, satire, parody and excitement; music and art can capture and shift the national mood. Think the 2015 Equal Marriage plebiscite in Ireland.

- Referendums are rarely well played by the media, especially where there is no embedded referendum culture – the media seek ‘presidential’ or ‘gladiatorial’ style’ contests, polar opposite positions, argument and conflict, as in elections, whereas the policy content of a plebiscite should permit richer, textured discourse; shades of grey should be encouraged, not pummelled into submission; doubt, worry and concern are legitimate feelings. Think Netherlands overturning the obscure EU-Ukraine trade deal.

- Referendums are often susceptible to undue diaspora influence, both in terms of out of country votes, but also contribution to the debate, positive and negative, funding and campaign support. The international media often look first to local (to them) voices, and ‘frame’ their hypothesis accordingly. Think various recent Greek polls…

Quintin Oliver ran Northern Ireland’s Good Friday Agreement YES Campaign in 1998, and advises globally on referendums, with Colombia and Cyprus polls upcoming soon.

by Ryan Gawn | Jul 22, 2015 | Conflict and security, Cooperation and coherence, Global system, Influence and networks, UK

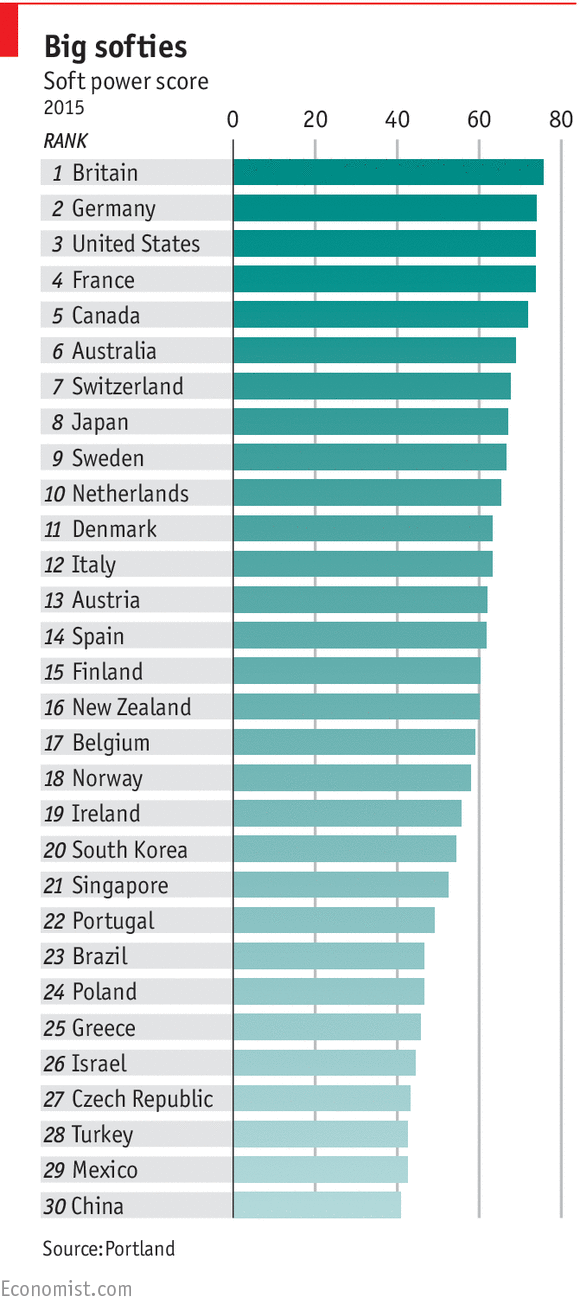

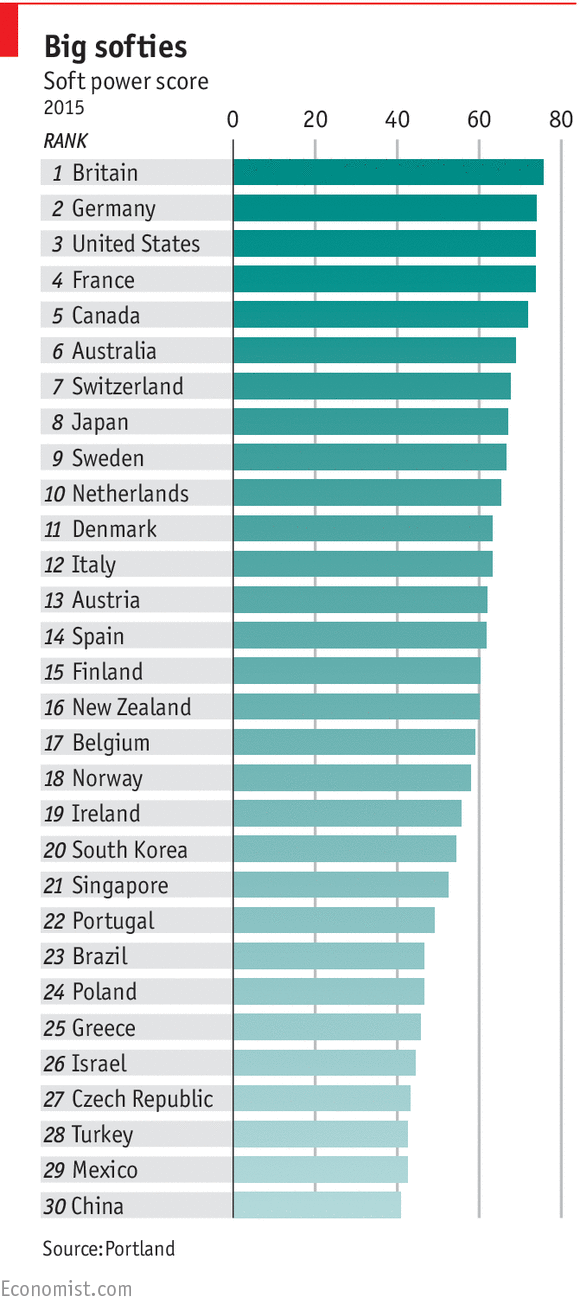

Last week saw the launch of a new global #softpower report, ranking the UK at the top of a 30-country index. Compiled by Portland, Facebook and ComRes, the report is described by Joseph Nye (who coined the term in 1990) as “the clearest picture to date of global soft power”, and has ranked countries in six categories (enterprise, culture, digital, government, engagement, education).

There are quite a few of these indices around now, with varying methodologies – nevertheless, this is the first to incorporate data on government’s online impact and international polling. Who’s at the top of the tables isn’t really surprising (the top 5 countries – UK, Germany, US, France, Canada – are identical to the top 5 in the Anholt-GFK Roper Nation Brand Index, but with a slight reordering of ranking). The US, Switzerland and France topped the specific categories, and although not first place in any of the categories, the UK ranked highest overall, reflecting its strength in culture, education, engagement & digital. More on the UK later.

What is really surprising is that China finishes last. Following a 2007 directive from Premier Hu Jintao, China has been investing heavily in soft power assets (such as the Xinhua news agency, aid/ development projects), at a time when others have been paring back their ambitions. Nevertheless, the impact of this investment isn’t borne out in the results, likely hindered by negative perceptions of China’s foreign policy, questionable domestic policies and a weakness in digital diplomacy. China came out strongest in the culture, likely reflective of the many Confucius Institutes dotted around the globe.

There are a few other interesting nuggets:

· Broader power trends are increasing the need for soft power – 3 factors driving global affairs away from bilateral diplomacy and hierarchies and toward a much more complex world of networks:

1. Rapid diffusion of power between states

2. Erosion of traditional power structures

3. Mass urbanisation

(more…)

by Ben Phillips | Apr 28, 2013 | Africa, Economics and development, Global system, UK

At this year’s G8 summit in Loch Erne, Northern Ireland, world leaders will meet to tackle the causes of global hunger. Sometimes the answer is right beside us. Close to the summit venue, in the grounds of a village church in Ardess, Fermanagh, a stone tribute reads simply “Within this Famine Pit lieth the unknown dead.” Perhaps the leaders should visit. Perhaps, too, they could consider the lessons of that history so they are not condemned to repeat it. Here are just a few:

- What is at stake is literally a matter of life and death. The million people who died in the Irish Famine in the Nineteenth Century, or the two million children dying every year from malnutrition globally in 2013, need to be remembered. They should be in leader’s minds when they ask themselves if something is “too difficult” or “will need more time”.

- Hunger is what happens when politicians fail. As the British Government acknowledged a century and a half after the Irish Famine, “those who governed in London at the time failed their people.” As Mo Ibrahim says, “When a child dies of hunger it is first and foremost a responsibility of government.”

- To tackle hunger, politicians need to be bold – in Nineteenth Century Ireland landgrabs by powerful land owners exacerbated poverty and conflict. Now, in developing countries, land the size of London is being bought and sold every six days, and the people living on the land sometimes don’t find out it’s been sold till the bulldozers turn up. It will take courage to take it on such a big issue. But if it’s not taken on now it will only get worse.

- Everyone will remember what the politicians do about it. For generations to come people will remember them. Will another apology need to be issued by future leaders for those who failed on hunger in Fermanagh in June 2013? Or will there instead be a celebration of those who that month started us on the road to Hunger Zero?

by Alex Evans | Oct 19, 2012 | Economics and development, Europe and Central Asia, Influence and networks

The FT’s Gillian Tett reports today on a conference presentation given by historical sociologist Dennis Smith, who’s been working on the question of how humiliation operates at the cultural / collective psychological level – and what this means for the Eurozone.

The whole article‘s worth reading, but here are a couple of highlights. First, on how humiliation works:

Psychologists believe the process of “humiliation” has specific attributes, when it arises in people. Unlike shame, humiliation is not a phenomenon which is internally driven, that is, something that a person feels when they transgress a moral norm. Instead, the hallmark of humiliation is that it is done by somebody to someone else.

Typically, it occurs in three steps: first there is a loss of autonomy, or control; then there is a demotion of status; and last, a partial or complete exclusion from the group. This three-step process usually triggers short-term coping mechanisms, such as flight, rebellion or disassociation. There are longer-term responses also, most notably “acceptance” – via “escape” or “conciliation”, to use the jargon – or “challenge” – via “revenge” and “resistance”. Or, more usually, individuals react with a blend of those responses.

So what does that mean for European politics? Well, Tett continues, the Eurozone’s periphery countries have indeed experienced “a loss of control, a demotion in relative status and exclusion from decision making processes (if not the actual euro, or not yet)” – and it’s interesting to observe how different European countries have used different coping strategies:

National stereotypes are, of course controversial and dangerous. But Prof Smith believes, for example, that Ireland already has extensive cultural coping mechanisms to deal with humiliation, having lived with British dominance in decades past. This underdog habit was briefly interrupted by the credit boom, but too briefly to let the Irish forget those habits. Thus they have responded to the latest humiliation with escape (ie emigration), pragmatic conciliation (reform) and defiant compliance (laced with humour).“This tactic parades the supposedly demeaning identity as a kind of banner, with amusement or contempt, showing that carrying this label is quite bearable,” says Prof Smith. For example, he says, Irish fans about to fly off to the European football championship in June 2012 displayed an Irish flag with the words: “Angela Merkel Thinks We’re At Work”.

However, Greece has historically been marked by a high level of national pride. “During 25 years of prosperity, many Greek citizens had been rescued by the expansion of the public sector?.?.?.?they had buried the painful past in forgetfulness and become used to the more comfortable present (now the recent past),” Prof Smith argues. Thus, the current humiliation, and squeeze on the public sector, has been a profound shock. Instead of pragmatic conciliation, “a desire for revenge is a much more prominent response than in Ireland”, he says, noting that “politicians are physically attacked in the streets. Major public buildings are set on fire. German politicians are caricatured as Nazis in the press?.?.?.?the radical right and the radical left are both resurgent.”

Prof Smith’s research has not attempted to place Spain on the coach. But I suspect the nation is nearer to Greece in its instincts than Ireland; humiliation is not something Spain has had much experience of “coping” with in the past. Whether the Spanish agree with this assessment or not, the key issue is this: if Angela Merkel or the other strong eurozone leaders want to forge a workable solution to the crisis, they need to start thinking harder about that “H” word. Otherwise, the national psychologies could yet turn more pathogical.

by Jules Evans | Dec 3, 2010 | Economics and development

The ECB yesterday slightly increased its bond purchasing programme, but did not push the nuclear button and announce some huge new programme of QE or bank re-capitalizations, as some in the bond markets were screaming for.

The editor of Euroweek, one of the finance mags I write for, reckons the ECB played it well:

There has been no shortage of thundering demands from bankers and investors for a vast wave of quantitative easing from the European Central Bank. Speaking to people in the market this week has at times felt like hosting the sort of talk radio show that attracts prophet of doom taxi drivers and the more outspoken members of the National Rifle Association. Amid the talk of meltdown and default, immediate “shock and awe” spending by the ECB was prescribed as the only thing that could save the world from a terrible peril.

The response from the ECB was predictably less aggressive, more nuanced and, for now, more appropriate. Trichet is not a politician: he does not do shock and awe, he never has and nor should any central banker. Central banks are there to keep things stable and boring. Further, this would be the wrong time to let slip the dogs of QE war. Yields on peripheral sovereign debt have made back some or all of the ground lost earlier in the week. A lot of firms are about to shut their books for the year. Borrowers do not have a whole lot more borrowing to do, if any at all.

So why, pending any reckless statements from a European politician, with volumes about to lighten, would the ECB worry about doing anything before Christmas? Next year is sure to provide plenty of problems. Now is not the moment to go nuclear.

I agree. I’ve noticed this pattern over the last decade, whenever financial crises occur: the markets shriek ever louder that governments ABSOLUTELY MUST come to the rescue or ALL HELL will break loose. This generates such a general sense of panic and catastrophe that terrified politicians cave in and open the tax purses, and then bankers get bailed out, close their positions, and hail a cab to the gentlemen’s club for whiskies and cigars.

Private banks are, really, the perfect parasite: if you look at financial news, almost all the ‘expert opinions’ come from bankers, from bank economists, from bank analysts, from bank traders. There are hardly any alternate views given in the media. The taxpayer doesn’t really have a representative to put forward our views on CNBC. So the financial sector has captured information transmission, and it makes sure the only message that gets through is: it is imperative that the market gets supported and the banks and boldholders get bailed out. The perfect parasite.

So has the ECB stood firm against the histrionic Gillian McKeith-esque fainting of the bond markets? Well…sort of. It also emerged this week that the Irish government will protect all senior bank bondholders from any hair cut in the restructuring of Anglo Irish Bank, and probably of other bailed out banks too. This taxpayer largesse towards senior bank bondholders came at the insistence of the ECB, according to the Irish government. And that pattern is likely to be followed in other bank bail-out regimes across the periphery of Europe.

So don’t worry, oh hysterical bondholders. The gallant ECB will hold your hand after all. Quick, fetch the smelling salts!

no candidates and no posts to win, and although parties are involved, they and the voters are addressing an issue; campaigners must ‘unlearn’ their election campaigning instincts. First mover advantage often goes to those who successfully ‘frame’ the terms of debate. Think Brexit, as ‘taking back our country’.

no candidates and no posts to win, and although parties are involved, they and the voters are addressing an issue; campaigners must ‘unlearn’ their election campaigning instincts. First mover advantage often goes to those who successfully ‘frame’ the terms of debate. Think Brexit, as ‘taking back our country’. issues, against a background of conflict, usually become more emotional, than rational; voters express their instincts, rather than their cold, rational, evidence-based selves. They remember the past and are reluctant to embrace an uncertain – or overly idealistic – future. Think Scotland 2014.

issues, against a background of conflict, usually become more emotional, than rational; voters express their instincts, rather than their cold, rational, evidence-based selves. They remember the past and are reluctant to embrace an uncertain – or overly idealistic – future. Think Scotland 2014. voices – voters tend to look first to their political party of choice for advice but then seek other cues from voices they trust, or who appear widely to be opinion-formers (churches, labour unions, NGOs, artists, celebrities, athletes…); voters especially like to see traditionally opposing politicians putting aside their differences in the national interest and sharing platforms to promote their unified case, especially if this contrasts with the opponents. Think Good Friday Agreement poll in 1998.

voices – voters tend to look first to their political party of choice for advice but then seek other cues from voices they trust, or who appear widely to be opinion-formers (churches, labour unions, NGOs, artists, celebrities, athletes…); voters especially like to see traditionally opposing politicians putting aside their differences in the national interest and sharing platforms to promote their unified case, especially if this contrasts with the opponents. Think Good Friday Agreement poll in 1998. to organised civil society (usually excluded from traditional elections) – since it can articulate bottom-up, grassroots depth and richness around the issues for debate, with knowledge and experience, credibility and authenticity. Elections are rarely ‘fun’, but referendums can give expression to creativity, satire, parody and excitement; music and art can capture and shift the national mood. Think the 2015 Equal Marriage plebiscite in Ireland.

to organised civil society (usually excluded from traditional elections) – since it can articulate bottom-up, grassroots depth and richness around the issues for debate, with knowledge and experience, credibility and authenticity. Elections are rarely ‘fun’, but referendums can give expression to creativity, satire, parody and excitement; music and art can capture and shift the national mood. Think the 2015 Equal Marriage plebiscite in Ireland.