by Alex Evans | Jun 22, 2010 | Climate and resource scarcity

Hard to argue with this one from Monbiot:

Call me a hard-hearted bastard, but I’m finding it difficult to summon up the sympathy demanded by the institutional investors now threatening to sue BP. They claim that the company inflated its share price by misrepresenting its safety record. I don’t know whether this is true, but I do know that the investors did all they could not to find out. They have just been presented with the bill for the years they spent shouting down anyone who questioned the company.

They might not have been warned by BP, but they were warned repeatedly by environmental groups and ethical investment funds. Every year, at BP’s annual general meetings, they were invited to ask the firm to provide more information about the environmental and social risks it was taking. Every year they voted instead for BP to keep them in the dark. While relying on this company for a disproportionate share of their income (BP pays 12% of all UK firms’ dividends), they refused to hold it to account.

It’s not as if the warning signs were hard to spot. One of them is splashed across the front page of BP’s 2009 annual review: the title is “Operating at the energy frontiers”. Like all multinational oil companies, BP has been shut out of the easy fields by the decline of its old reserves and the rising power of state-owned companies. So, to keep the money flowing, BP takes risks that other companies won’t contemplate. “Risk,” the review states, “remains a key issue for every business, but at BP it is fundamental to what we do. We operate at the frontiers of the energy industry, in an environment where attitude to risk is key … We continue to show our ability to take on and manage risk, doing the difficult things that others either can’t do or choose not to do.”

by Alex Evans | Nov 11, 2009 | Climate and resource scarcity, Economics and development, Global Dashboard

I’ve said before that the easing of oil and food prices that followed the credit crunch and the global downturn gave policymakers a window of opportunity to take preventive action on scarcity issues. Now, alas, I think that window is starting to close – without their having done much about it.

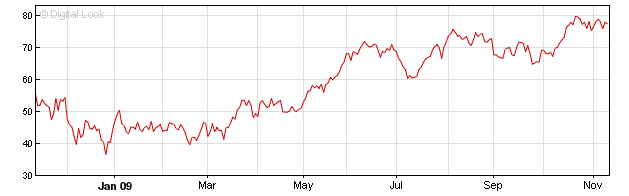

To see why, first take a look at what the oil price has been doing over the last year (Brent crude futures, $/barrel; h/t BBC):

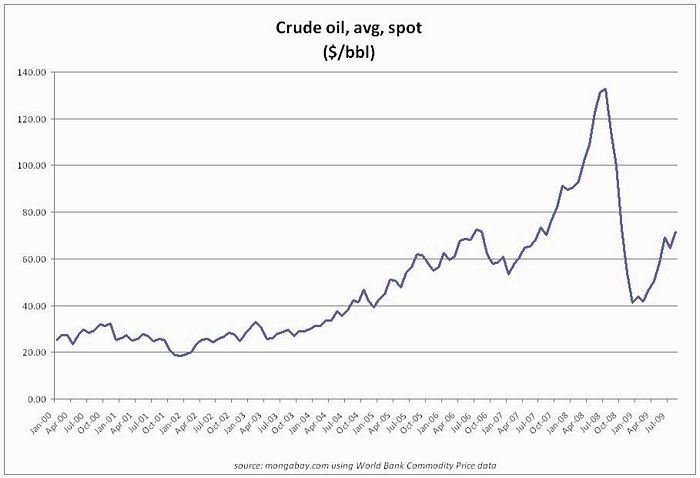

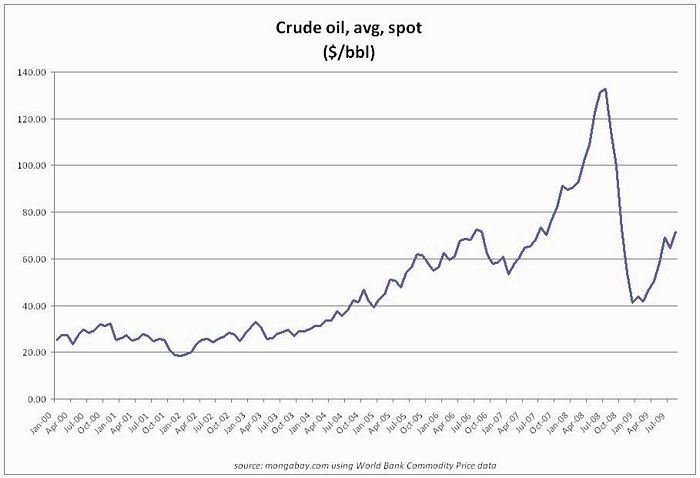

Then, put that against the longer term background of what’s been happening since 2000 (slightly older data here, via Mongabay, but usefully puts the BBC graph above in context):

As the second graph shows, today’s level of just under $80 per barrel already brings us back to where we were in around July 2007 – and that’s during a still shaky recovery from what’s generally agreed to have been the worst global recession since the early 1930s.

This is a striking rebound in such weak economic conditions – and calls to mind the consistent warnings from the IEA over the past 18 months that the collapse in investment in new supply during the financial crisis and subsequent downturn has set the stage for a new oil price crunch as soon as recovery gets underway (not to mention the fact that IEA’s chief economist thinks we’re looking at peak oil as soon as 2020).

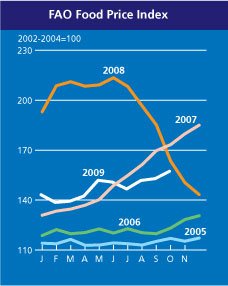

With the oil price headed upwards, food prices can be expected to follow – because higher oil prices make biofuels more attractive, and raise the prices of on-farm energy use, fertilisers, transportation, distribution and various other elements of our energy-intensive food supply chains.

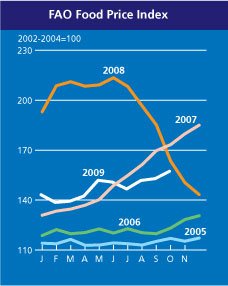

Sure enough, if we take a look at the latest FAO food price index, we find that it too has been quietly heading upwards over the last few months – and is now likewise back at where it was in July 2007. At that point, of course, the food spike was already well underway, with the tortilla riots in Mexico City that served as a wake-up call for many policymakers having come almost six months earlier.

On top of this, remember the really key point that the fall in food prices that took place during the global downturn gave minimal respite to the world’s poorest people – precisely because even as prices fell, they were also getting hammered themselves by the downturn.

The starkest indication of that is in the global total of undernourished people (shown here in a graph from the FT); when you realise that we haven’t just lost the progress of the last few years, but are in far worse shape that at any time since the last 60s, you start to see just what a catastrophe the combination of food / fuel price spike followed by global downturn has been for development:

As I’ve argued in numerous previous posts, we were never out of the woods on the food / fuel pincer movement; it was the collapse in prices following the credit crunch that was the blip, not the price spike that preceded it. And what’s most frustrating now is the extent to which policymakers have frittered away the chance we had to get onto a more secure footing.

(more…)

by Alex Evans | Oct 9, 2009 | Economics and development, Global system

Tumultuous times for the dollar this week. Gold has hit an all-time high three days in a row (this morning it’s at $1,045 troy ounce – it was only $990 on 29 September) while WTI oil is up at $71.50 a barrel todaycompared to $66 just over a week ago – both commodities head upwards when the greenback’s going the other way. So what was going on? Over to the NYT for the stocks and bonds report in Wednesday’s paper:

Investors clamored to buy pretty much anything on Tuesday — as long as it was not the dollar. A seven-month slide in the value of the dollar gained force as investors migrated to other markets and fretted over a report that crude oil could one day be priced in other currencies, hobbling the dollar’s role as a vehicle for global trade.

Whatever would give investors that idea, you wonder? Answer:

A report on Tuesday in The Independent, a British newspaper, suggested that China, France, Japan and Russia were in secret talks with Persian Gulf countries to abandon the dollar for international trade in oil and replace it with a basket of currencies and gold.

The Independent? Not the FT, not the WSJ, but the Independent? Yup, the FT’s Alphaville blog says so too:

The Independent appears to have rocked the world on Tuesday with its Robert Fisk exclusive exposing a secret plot by international central banks to topple the US dollar.

So what on earth did he say that managed to move markets on the other side of the Atlantic?

(more…)

by Alex Evans | Oct 5, 2009 | Climate and resource scarcity, Economics and development

Deutsche Bank have good news and bad news, as the Wall Street Journal’s excellent Environmental Capital blog recounts:

Here’s an intriguing thought: Global oil supplies are indeed set to peak within a few years, and no, that is not bullish for oil. Quite the contrary—it will spell the end of the “oil age.”

That’s the take from Deutsche Bank’s new report, “The Peak Oil Market.” In a nutshell: The oil industry chronically under invests in finding new supplies, exemplified both by Big Oil’s recent love of share buybacks and under-investment by big oil-producing nations. That spells a looming supply crunch.

That will send oil to $175 a barrel by 2016—and will simultaneously put the final nail in oil’s coffin and send prices plummeting back to $70 by 2030. That’s because there’s an even more important “peak” moment on the horizon: A global peak in oil demand. That has already begun in the world’s biggest oil-consuming nation, Deutsche Bank notes:

US demand is the key. It is the last market-priced, oil inefficient, major oil consumer. We believe Obama’s environmental agenda, the bankruptcy of the US auto industry, the war in Iraq, and global oil supply challenges have dovetailed to spell the end of the oil era.

The big driver? The coming-of-age of electric and hybrid vehicles, which promise massive fuel-economy gains for short-hop commuting but which so far have not been economic.

Deutsche Bank expects the electric car to become a truly “disruptive technology” which takes off around the world, sending demand for gasoline into an “inexorable and accelerating decline.”

by Alex Evans | Aug 1, 2009 | Climate and resource scarcity

Is a peak for global oil demand in sight, wonders the Guardian’s Data Blog this morning? Er, no – what might make them think that, you wonder? Answer: a new Greenpeace report called Shifting Sands, which argues that the case for developing tar sands in Canada is rapidly diminishing as oil demand falls. The report pulls together demand forecasts from OPEC and IEA, and argues that on top of the effects of the recession,

“In the longer term, the impact of two key policy instruments adopted in the US and EU are cited as gaining in influence. These are the US Energy Independence and Security Act and the EU Climate and Energy package. These policies, and the fact that there has been a degree of saturation in these markets, have led to the unanimous conclusion among these agencies that oil demand in the OECD has peaked.”

OECD, schm-OECD! They’re beside the point! Let’s remind ourselves of what the last IEA Outlook report actually said:

Global primary demand for oil (excluding biofuels) rises by 1% per year on average [in the report’s Reference Scenario], from 85 million barrels per day in 2007 to 106 mb/d in 2030 … all of the projected increase in world oil demand comes from non-OECD countries.

It is entirely true to point out, as Greenpeace do, that investment in tar sands has fallen off a cliff as oil prices have crashed from $147 last July to their current level of around $60, and that investor uncertainty over future demand is the big driver here.

But to go from there to talking about a peak in world oil demand? I wish.