Office of Budget Responsibility – laughing stock

I remember being astonished by the rose-tinted specs donned by the UK’s Office of Budget Responsibility (“independent and authoritative analysis of the UK’s public finances”) as as it was created in the run up to the 2010 budget:

We expect the economic recovery to strengthen in 2010 and beyond, as private sector demand continues to pick up. We estimate that trend output will grow at just over 2¼ per cent over the next three years…

From 2011 onwards, GDP is expected to grow at an above-trend rate as the economy rebalances away from consumption towards investment and net exports.

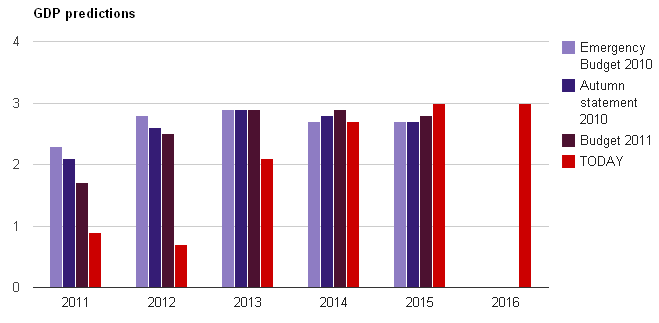

That worked out well, didn’t it? Here’s a graphic showing how badly the OBR got it wrong (Datablog has an interactive version).

Each of the OBR’s forecasts – including the one released today for George Osborne’s autumn statement – has been markedly less optimistic about the near term than its predecessor, while continuing to be sure things will look a lot better in just a few years’ time.

Initially, I put the OBR’s eagerness to please the government down to weak leadership and expected things to improve when the fearsome Robert Chote took charge of the new body. But, if anything, they have got worse. Here’s the OBR’s latest fan chart which shows how bad (good) things could be fir the UK economy, based on errors in previous Treasury forecasts. Looking at it and you’d conclude that – worst case – the UK might lose 2% of GDP next year (dreadful, but nothing like as bad as 2008):

The OBR also makes a big deal of how important it is to “recognise uncertainty” and to “stress test” its assumptions. One stress is (surprise, surprise) further turbulence in the eurozone:

Our central forecast is predicated on the euro area finding a way through its current difficulties, with the effect on confidence, credit conditions and economic activity taking some time to unwind, but with the financial sector returning to a stable position by the start of 2014. In this scenario we consider the implications of the financial sector taking longer to normalise (for reasons either to do with events in the euro area or with domestic factors).

The central prediction, then, is for a two-year quick fix for the euro, which seems highly implausible to me. What about the downside? All we get is a scenario that models “persistent tight credit conditions… for reasons either to do with events in the euro area or with domestic factors.” And that leads to… a blip. Growth is totally unaffected next year (GDP up 0.9%) and is only very slightly lower in the next two years (GDP up 1.6% and 2.3%). After that, life is back to normal.

At a time of maximum danger for the UK economy, we have a fiscal watchdog whose ‘stress’ tests are ludicrously unstressful, because anything harsher “is impossible to quantify in a meaningful way.” It’s like a doctor who suspects her patient is dying of cancer, but focuses on his ingrowing toenail because it’s “easier to see.”

George Osborne promised us a body that would reassure the public. Instead, the OBR has persistently failed to model the forces tearing the British economy apart. His new creation risks becoming a laughing stock if it doesn’t quickly mend its ways.