by Alistair Burnett | May 24, 2012 | Economics and development, Europe and Central Asia, UK

Here’s a piece I’ve done for Yale Global magazine on democracy under strain in Europe.

Politicians in power since the 2008 financial collapse, regardless of their political stripes, find themselves in peril. Analysis of the recent French and Greek elections followed three lines of thought: voters soundly rejecting strict austerity measures, blaming incumbents, and abandoning mainstream political parties for more extremist leadership, both right and left. The three interpretations are linked. Read more

by David Steven | Dec 9, 2011 | Economics and development, Europe and Central Asia, Global system, UK

What a day. Five observations:

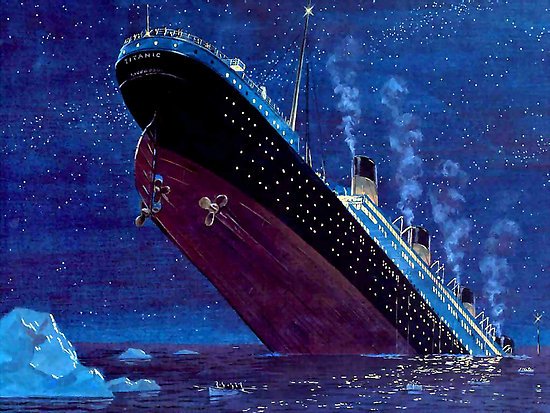

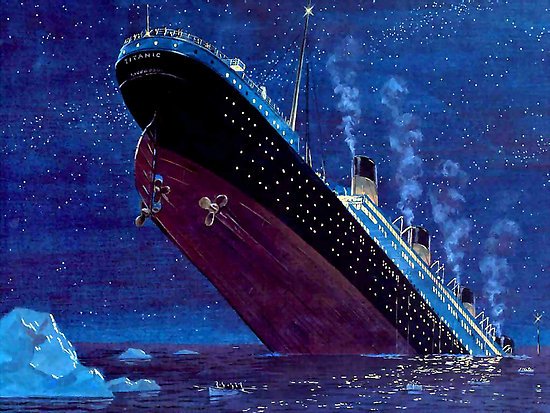

- My initial reaction this morning: On a sinking Titanic, the UK is lobbying to avoid further damage to the iceberg. If David Cameron was motivated mostly by his wish to suck up to the City (and to his backbenchers), then he deserves all that fate can throw at him. He has transformed eventual British exit from the EU from Eurosceptic fantasy to the new conventional wisdom in just 12 hours. Quite a feat.

- But maybe… his government has decided that the euro is now doomed and has made a rational decision to swim as far from the vortex as possible. Many believe that a disorderly break up of the single currency has become more likely than not. That would probably cost the UK 10% of GDP and make British default a near certainty. But if that’s what’s going to happen, then we better knuckle down to being as resilient to the shock as possible.

- The British veto makes euro failure more, not less, likely. In theory, agreement between a core group is easier than having all 27 countries in the room, but the legal complications of conjuring a new set of institutions from thin air are daunting. Also, expect the core to shrink as the summit’s aspirations are chewed up by domestic politics. Each defection will provide a potential trigger for wider breakdown – probably when a group of the strong decide all hope is lost, and make a collective rush to the lifeboats. By being the first to desert the ship, Cameron has made it much easier for other European leaders to follow.

- Contingency planning must now go much deeper. Behind the scenes, governments are playing out failure scenarios, and most big businesses have some kind of post-euro plan in place. Much of the thinking is still pretty rudimentary, however. The eurozone countries can’t risk letting markets see them flinch and have to put a brave face on their prospects, but the UK no longer needs to have such scruples. What exactly would we do if the euro goes down? What would be thrown overboard? What, and who, would be saved? How can the government organise effective collective action as the catastrophe hits?

- Nick Clegg is dead, politically. That was already true, but I can’t imagine even Miriam González Durántez now plans to support her husband at the next election. Paradoxically, accepting his terminal status could give Clegg new freedom of action. Instead of continuing to play the role of coalition gimp, he should offer leadership to those keen to explore what comes after the storm. Politicians with proper jobs – Cameron, Osborne, even Cable – are going to be overwhelmed by events throughout this parliament, even in the best case where Europe struggles back onto its feet. Clegg, though, has an opportunity to focus energy on the longer term. He’ll still lead the Lib Dems to electoral Armageddon, but catalysing a vision for renewal might make posterity a little kinder to the poor man.

by David Steven | Nov 15, 2011 | UK

Over the weekend, Will Hutton offered a ‘modest proposal’ so bizarre that it must have left his colleagues at the Observer fearing for his sanity.

David Cameron, he suggested, should…

… travel to Germany and make a speech in German – however embarrassing – spelling out the choices. If Germany is unprepared to accept them, he should argue that the least bad option is not for Greece to leave the euro – but for Germany, whose economy is strong enough to take the shock, to do so.

He should say that while it was right for Britain not to join the single currency as it was previously constructed, if Germany were to act responsibly, Britain would peg sterling to a reformed euro and in the long run even consider joining the regime. Moreover, Britain would do this either way, he could argue – eventually joining a single currency in which Germany accepted its responsibilities or a single currency without Germany.

Now the idea that Cameron should offer to swap places with Angela Merkel at the heart of the Euro meltdown is, without doubt, genius. The Germans, I am told, feel cursed to stagger on endlessly chained to the corpses of weaker European nations. So… why not help out? Strap them to the UK instead!

But it’s Hutton’s tactics I worry about. Year after year, with consummate skill, he’s been inching [sorry, centimetring] Britain towards Euro membership.

Who can forget his moving plea from ’99 that the UK adopt the single currency because “we read the same bible, drink the same wine, haunt the same discos, play in the same Champions League” as our European neighbours?

Or his reassurances from 2002 that fears the Euro could crack were ‘scaremongering’ and ‘wishful thinking’? Or his masterful solution for the problem of one-size-fits-all interest rates (in a crisis, European countries survive by running up bigger deficits!)?

Or from November 2008, his Cassandra-like insight that only through immediate Euro entry – now, this minute – could the UK avoid ‘national bankruptcy’ and the ‘clutches of the IMF’?

Or perhaps most prophetic of all, his essay from just a fortnight ago, hailing European leaders for taking an ‘inspiring leap’ towards financial stability, by creating “a self-help club” in which every European country could be both strong and free?

But it’s the language thing that makes me fear Hutton is losing his marbles. Our PM may not be able to speak a word of yer’actual German, but he can do a hilarious German accent (this is taught to all boys as part of the British national curriculum). He even whipped it out on the campaign trail:

[youtube]http://www.youtube.com/watch?v=Sp4nwcBgx0A[/youtube]

What’s more, he’s almost certain to push things too far by borrowing a costume from Prince Harry to make his big day in Berlin memorable for all concerned. The likelihood of embarrassment is overwhelming! He’s sure to come across more John Cleese than JFK.

No – what Cameron should do, obviously, is resign forthwith and allow Nick Clegg a fluent German speaker to take over. Clegg could then appoint a government of technocrats to prep the UK for Euro membership. I nominate one Hutton, W as our next Finanzminister….

by David Steven | May 14, 2010 | Europe and Central Asia

Seems Nicolas Sarkozy, Global Dashboard’s favourite European leader, was in typically understated form during the recent Eurozone crisis summit:

Sarkozy demanded “a compromise from everyone to support Greece … or France would reconsider its position in the euro,” according to one source cited by El País.

“Sarkozy went as far as banging his fist on the table and threatening to leave the euro,” said one unnamed Socialist leader who was at the meeting with Zapatero. “That obliged Angela Merkel to bend and reach an agreement.”

by David Steven | May 11, 2010 | Europe and Central Asia, UK

UK reluctance to help with the Euro bailout has not gone down well at all:

Jean-Pierre Jouyet, the head of the French markets regulator, said sterling was bound to come under pressure on the markets given the delay in forming a UK government after last week’s inconclusive general election.

Mr Jouyet, a former Europe minister who is close to President Nicolas Sarkozy, indicated that Britain could expect no help from the eurozone.

“The British are most definitely going to be targeted given the political difficulties they have,” he told Europe1 radio. “If they don’t want solidarity with the eurozone, we will see what will happen with regard to the United Kingdom.”

Following its refusal to help its neighbours, Mr Jouyet said Britain had become a peripheral player in the bloc.

There was now a “three-speed Europe”, he said: “Europe of the euro, the Europe of countries that understand the euro, such as Poland and Sweden, and the British.”