by David Steven | Dec 9, 2011 | Economics and development, Europe and Central Asia, Global system, UK

What a day. Five observations:

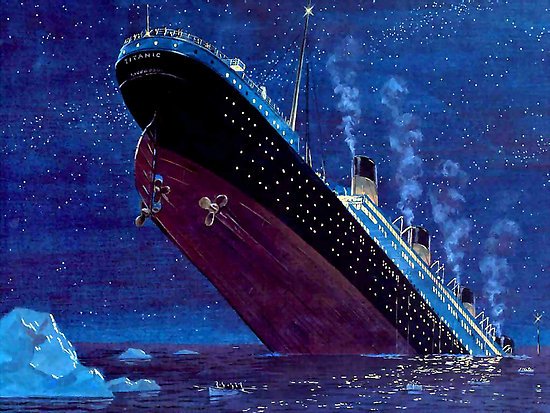

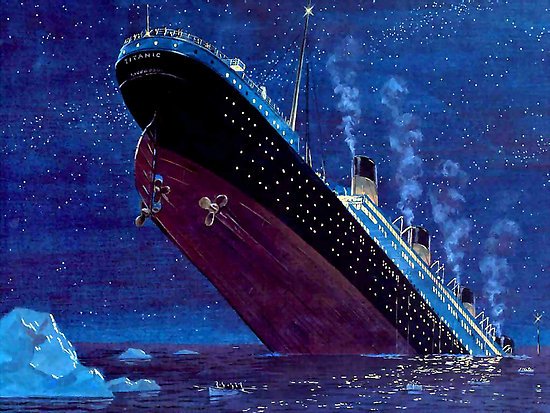

- My initial reaction this morning: On a sinking Titanic, the UK is lobbying to avoid further damage to the iceberg. If David Cameron was motivated mostly by his wish to suck up to the City (and to his backbenchers), then he deserves all that fate can throw at him. He has transformed eventual British exit from the EU from Eurosceptic fantasy to the new conventional wisdom in just 12 hours. Quite a feat.

- But maybe… his government has decided that the euro is now doomed and has made a rational decision to swim as far from the vortex as possible. Many believe that a disorderly break up of the single currency has become more likely than not. That would probably cost the UK 10% of GDP and make British default a near certainty. But if that’s what’s going to happen, then we better knuckle down to being as resilient to the shock as possible.

- The British veto makes euro failure more, not less, likely. In theory, agreement between a core group is easier than having all 27 countries in the room, but the legal complications of conjuring a new set of institutions from thin air are daunting. Also, expect the core to shrink as the summit’s aspirations are chewed up by domestic politics. Each defection will provide a potential trigger for wider breakdown – probably when a group of the strong decide all hope is lost, and make a collective rush to the lifeboats. By being the first to desert the ship, Cameron has made it much easier for other European leaders to follow.

- Contingency planning must now go much deeper. Behind the scenes, governments are playing out failure scenarios, and most big businesses have some kind of post-euro plan in place. Much of the thinking is still pretty rudimentary, however. The eurozone countries can’t risk letting markets see them flinch and have to put a brave face on their prospects, but the UK no longer needs to have such scruples. What exactly would we do if the euro goes down? What would be thrown overboard? What, and who, would be saved? How can the government organise effective collective action as the catastrophe hits?

- Nick Clegg is dead, politically. That was already true, but I can’t imagine even Miriam González Durántez now plans to support her husband at the next election. Paradoxically, accepting his terminal status could give Clegg new freedom of action. Instead of continuing to play the role of coalition gimp, he should offer leadership to those keen to explore what comes after the storm. Politicians with proper jobs – Cameron, Osborne, even Cable – are going to be overwhelmed by events throughout this parliament, even in the best case where Europe struggles back onto its feet. Clegg, though, has an opportunity to focus energy on the longer term. He’ll still lead the Lib Dems to electoral Armageddon, but catalysing a vision for renewal might make posterity a little kinder to the poor man.

by Alex Evans | Dec 2, 2008 | Conflict and security, Influence and networks, North America

As regular readers will know (since I post this quote about once a month), I’m a fan of Milton Friedman’s sage advice to his fellow monetarists when they were still voices in the wilderness: “Only a crisis — actual or perceived — produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes politically inevitable.”

So it’s deeply gratifying to see that Barack Obama’s pick for White House chief of staff, Rahm Emanuel, is clearly no slouch either when it comes to seeing the opportunities in big crises. Here he is doing an interview for the Wall Street Journal – excerpt:

You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things that you think you could not do before. I think America as a whole in 1973 and 1974 … missed the opportunity to deal with the energy crisis that was before us. For a long time our entire energy policy came down to cheap oil. This is an opportunity – what used to be long term problems, be they in the healthcare area, energy area, education area, fiscal area, tax area, regulatory reform area, things we had postponed or too long that were long term are now immediate and must be dealt with. And this crisis provides the opportunity for us … to do things that we could not do before. The good news is … the problems are big enough that they lend themselves to ideas from both parties for the solution.

by Jules Evans | Apr 15, 2008 | Global system

We’re now in the point-the-finger phase of the present financial crisis. The G7 says its all the banks’ faults, and wants to increase their capital adequacy requirements. The banks say its nobody’s fault, and want governments to bail them out. Many economists say its Alan Greenspan’s fault for cutting rates so low and for so long in 2001-2006. Alan Greenspan says its risk managers’ fault.

Here’s my two-pence-worth, from an amateur market-observer with no economic qualifications: beware new markets.

When you look at the great speculative bubbles of the last 20 years, they almost always occur in new and untested markets, markets that have never gone through a downturn, so there is no investor knowledge of their upper limit, and little regulator awareness of the frauds or legal loopholes that investors can exploit.

Thus the Russian financial crisis of 1998 was, among other things, a new market, in which investors had no experience of a crash. That helped drive the euphoria and risk-appetite of local and foreign investors.

The dotcom bubble in the same period was also a new market, based on ‘new economy’ stocks, which seemed so new that analysts and investors threw away their scepticism and convinced themselves these stocks would only go up and up.

The California power crisis of 2001 was also a new market, created by the deregulation of the power sector in that county. The newness of the market meant regulators had not fully got to grips with how the market worked or how unscrupulous investors could exploit the system. Enron, masters of financial innovation and wizardry, were quick to find the loopholes in the untested regulation, and they made a killing at the expense of California, which faced rolling blackouts as greedy traders took electricity out of the county, then brought it back in at double the price.

And the CDO boom of the last six years is another new and untested market, which neither regulators nor banks’ senior management fully understood. Regulators didn’t understand the risks involved. Bank senior management didn’t want to understand, as long as the traders putting together these deals kept bringing in the money.

The moral is that risk managers, and regulators especially, should be wary of new markets that start to grow exponentially quickly. It probably means that investors have found some way of making money which they think is full-proof, and they’re taking dangerous risks.