by Seth Kaplan | Aug 27, 2013 | Conflict and security, Middle East and North Africa

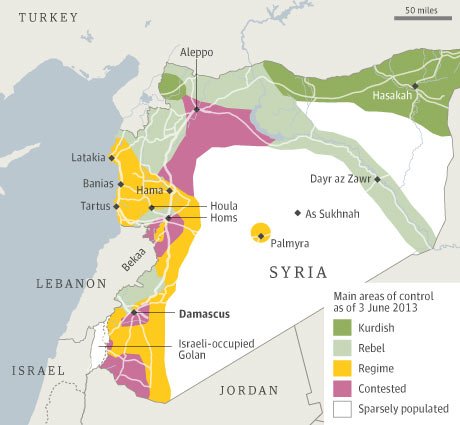

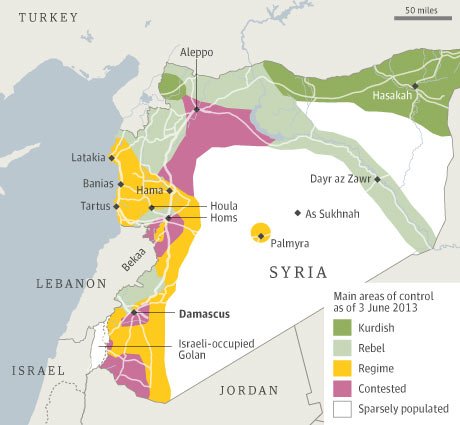

As the war in Syria drags on, it is becoming ever more vicious. Militias kill hundreds of civilians, ethnic cleansing large swaths of the country in the process. Rebel groups fight among themselves for territory and even assassinate each other’s leaders. Prisoners are regularly tortured. Millions have fled their homes in fear. 100,000 are dead. Extremists now hold the upper hand on both sides. In the latest outrage, the Assad regime has apparently used chemical weapons, gassing hundreds to death.

As the war in Syria drags on, it is becoming ever more vicious. Militias kill hundreds of civilians, ethnic cleansing large swaths of the country in the process. Rebel groups fight among themselves for territory and even assassinate each other’s leaders. Prisoners are regularly tortured. Millions have fled their homes in fear. 100,000 are dead. Extremists now hold the upper hand on both sides. In the latest outrage, the Assad regime has apparently used chemical weapons, gassing hundreds to death.

Where will all this misery lead? What does the future of Syria hold?

As I warned in 2011, Syria is a complex mosaic of different ethnic, religious, and ideological groups, a tinderbox that was destined to explode if the fragile peace that the Assad regime enforced was disturbed. Now that the country has imploded, there is no easy way out. (more…)

by Daniel Korski | Feb 10, 2009 | Conflict and security, Cooperation and coherence, UK

For many years, the US has influenced UK national security thinking and vice versa. The 1947 National Security Act, pushed through by Harry Truman, was in many ways an attempt at copying the British system of government, which US policy-makers and commanders had come to admire during the years of close US-UK collaboration during WWII.

Later on, the influence tended to move the other way. The 1986 Goldwater-Nicols Act, which put the “joint” into the Pentagon, had as profound an effect on UK military organisation as the general staff system originally employed in Napoleon’s Grande Armée.

But whereas previously the ideas were studied and adapted to the UK’s constitutional set-up, today it seems anything invented in the US should be imported wholesale to the UK, regardless of whether it fits the political, legal and constitutional set-up or not.

So Richard Holbroke’s appointment as President Obama’s Special Representative for Afghanistan and Pakistan has now been matched by the choice of Sherard Cowper-Coles as the Foreign Secretary’s Envoy to Afghanistan and Pakistan. This adds to Jack McConnell’s role as Special Envoy for Conflict Resolution and what is rumoured to be Des Browne’s imminent appointment as the Prime Minster’s envoy to Sri Lanka. (more…)

by David Steven | Jan 30, 2009 | Climate and resource scarcity, Cooperation and coherence, Global system

Image Author: mike_is_scrumptious

Assume a robust global deal on climate and the world’s cities will have to transform their infrastructure, economies and societies in little more than a generation.

Assume uncontrolled emissions growth and they face growing impact from a less hospitable and more volatile climate.

Either way – big changes are on the way. Few cities’ leaders grasp the scale of the challenge, especially in developing countries, where towns and cities will have an additional 1.5bn residents to cope with by 2030.

This new think piece has been prepared as part of the British Council’s Climate and Cities programme. Download the pdf (which has full references) or read the full text below the jump.

(more…)

by Alex Evans | Jan 28, 2009 | Conflict and security, Cooperation and coherence

A few days ago, I did a post on the UK government’s current horizon scanning exercise – part of the process leading up to its second National Security Strategy – in which I suggested that “the really stand-out risk that barely got a mention in the events I attended was the possibility that serious erosion of states’ capacity and legitimacy [will undermine] their ability to respond to all the global trends that we were discussing”.

As regular readers will know, that observation comes straight out of the writings of ‘fourth generation warfare’ theorists like William Lind, Martin van Creveld and John Robb. But what may come as more of a surprise is the interesting revelation that Kaiser Wilhelm II made a similar point yesterday in his birthday conversation with Lind*:

“My generation of kings and emperors were fixated on the age-old contest between dynasties. Would the houses of Hapsburg and Hohenzollern defeat those of Romanoff and Savoy or the other way around? We could not see the paradigm shift welling up all around us, the onward rush of democracy and equality and socialism and all the rest of that garbage. What we needed was an alliance of all monarchies against democracy. Instead we wiped each other out, putting the levellers in charge everywhere, to the world’s ruin.”

“Does that hold any lessons for our time?”, I asked.

“From Olympus, the picture could not be more clear,” His Majesty replied. “As we were mesmerized by dynastic quarrels, so your politicians cannot see beyond the state. They think only of states in conflict. Will America be threatened by China? Should India go to war with Pakistan? Is Iran a danger to Israel? They cannot see that states are now all in the same, sinking boat, just as all the dynasties were in 1914.”

“What should states then do?”, I enquired.

“Form an alliance of all states against non-state forces, what you call the Fourth Generation,” the Kaiser answered. “The hour is late, and the state system itself has grown fragile. That is the lesson of America’s quixotic war in Iraq. You destroyed the state there, and now no one can recreate it. That is what will happen almost everywhere when states fight other states. But none of your leaders can see it, because they, too, are time-blinded. It is the human condition.”

* Since you ask: in addition to being one of the top experts around on counter-insurgency and fourth generation warfare, William Lind is also an ardent Prussian monarchist. Consequently, he marks the birthday of Kaiser Wilhelm II (“my reporting senior and lawful sovereign”) with a column each year in which he records a conversation with that leader’s ghost. Previous editions are highly recommended – e.g. here and here.

by David Steven | Jan 21, 2009 | Climate and resource scarcity, Economics and development, Global Dashboard, Global system, London Summit

I’ve been in Japan today, speaking at ‘Reforming International Institutions – Meeting the Challenges of the 21st Century’, a seminar organized by the United Nations University and the British Embassy in Japan.

You can download my talk here (with pictures, references etc) – or the text only is available below the jump. There’s a webcast too.

Headlines:

- It’s going to be a tough year. The financial meltdown has a long way to go, and the downturn is risking turning into a global depression.

- Trade is a bell wether. Protectionist pressures are already on the rise. If they gain traction, take that as a warning of a wider loss of confidence in global institutions.

- The unravelling of global economic imbalances could prove corrosive to the international order. If countries start to devalue to protect exports, expect a tit-for-tat dynamic to kick in.

- Scarcity issues (energy, water, land, food, atmospheric space for emissions) remain the key medium term driver of global change. Commodity prices will spike again as soon as there’s recovery.

- The downturn has stemmed the uncontrolled growth of emissions, but also lessened the chance of a robust global deal on climate.

- Economic bad times could well drive increased conflict. A major new security threat might be the fabled black swan – hitting just when the global immune system is already overloaded.

- If we experience a long crisis (or a chain of interlinked crises), we are likely to see either a significant loss of trust in the system (globalization retreats), or a significant increase in trust (interdependence increases).

- You need to stretch time horizons to get the latter – shared awareness (joint analysis of risks and challenges), as a basis for shared platforms (loose coalitions of leaders), which can lobby for a shared operating system (a new international institutional architecture).

- 2009 sets a challenging agenda for the G20 (financial reform and economic recovery – but framed by a broader vision on climate, resources, security etc.)…

- …the G8 (caucus of rich countries able to tee up Copenhagen and kick start development assistance if developing countries begin to teeter)…

- …the UN (especially Ban Ki-Moon’s proposed high level ‘friend’s group’ on climate, but also as a fora for getting to grips with scarcity issues)…

- and the Bretton Woods institutions and the WTO (first of all ensuring they keep their heads above water, then looking to ‘save globalization from itself’).

- Oh and be ready for the backlash – people are angry and rightfully so, but that may well lead us down some populist blind alleys.

(more…)

As the war in Syria drags on, it is becoming ever more vicious. Militias kill hundreds of civilians, ethnic cleansing large swaths of the country in the process. Rebel groups fight among themselves for territory and even assassinate each other’s leaders. Prisoners are regularly tortured. Millions have fled their homes in fear. 100,000 are dead. Extremists now hold the upper hand on both sides. In the latest outrage, the Assad regime has apparently used chemical weapons, gassing hundreds to death.

As the war in Syria drags on, it is becoming ever more vicious. Militias kill hundreds of civilians, ethnic cleansing large swaths of the country in the process. Rebel groups fight among themselves for territory and even assassinate each other’s leaders. Prisoners are regularly tortured. Millions have fled their homes in fear. 100,000 are dead. Extremists now hold the upper hand on both sides. In the latest outrage, the Assad regime has apparently used chemical weapons, gassing hundreds to death.