In our paper on Bretton Woods II (pdf), Alex and I provide rather a gloomy assessment of financial crisis – which we suggest is going to last longer than many think…

Given that we now face what Gordon Brown has described as “the first truly global financial crisis of the modern world”, our bet would be that it takes as long as a decade to bring it fully under control.

Let’s unpack the assumptions behind our pessimism. We start from the premise that, six months back, experts were overly optimistic about how far-reaching the meltdown would be. This is based, in part, on April’s Progressive Governance summit, where heads of state were (a) clearly freaked out; (b) fairly sure they grasped the problem, if not the solutions; (c) not acting as if they expected any further big surprises.

Consider, too, what the IMF’s Dominique Strauss Kahn was saying at the time. He was as worried by inflation, as he was by economic slowdown. Although he was forecasting a “rather important, serious slowdown in economic growth” – the expected pain wasn’t really that bad:

Something around 0.5 percent as a rate of growth for the United States in 2008 and a slight recovery during 2009-an average of 0.6 percent for 2009, which is both linked to the financial turmoil, of course, but also the business cycle.

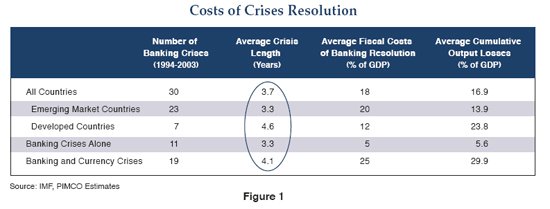

Next, we look at the lessons of earlier banking crises that, in developed countries, have tended to take four or five years to unravel, cost around 12% of GDP to resolve, and lead to a cumulative loss in output equal to almost a quarter of GDP. The figures are drawn from this useful chart prepared by PIMCO’s Michael Gomez:

Then add in what we know about the banking crisis that gripped Japan in the 1990s, which the IMF ascribes to “accelerated deregulation and deepening of capital markets without an appropriate adjustment in the regulatory framework”. Hiroshi Nakaso’s account is worth reading in full – seven years of crisis management and fire fighting as a senior manager at the Bank of Japan.

“When the bubble burst in the early 1990s, no one expected it was going to usher in such a prolonged period of weak growth in Japan,” he writes. Policy makers underestimated the seriousness of the problem, while banks lacked the ‘foresight and courage’ to confront their predicament head on.

At the time there was considerable schadenfreude in the West about Japan’s failure to get to grips with its crisis. It was eight years or so before its policy makers even found the levers that would begin to inch the crisis towards a solution. Are we right to assume that we’ll now do better?

Perhaps not. After all, as Hiroshi Nakaso argues, things moved slowly because a profound psychological shift was needed, with the Japanese letting go of basic assumptions about how Japan functioned. This was a long and painful process:

Bank managers were forced to recognise that they could no longer expect unconditional rescue and protection by authorities when banks faced serious problems. For bank employees, this meant that the traditional lifetime employment could also be destroyed, potentially in a violent way. For the authorities too, the 1990s was a decade in which they had to change their perspective and approach in dealing with a troubled bank. As they experienced one case after another, they realised that the option of failure would generally be preferable to a bailout unless there was a clear economic rationale for the latter. Meanwhile, depositors were forced to abandon the myth that banks would not be allowed to fail.

This was a full reversion of fundamental concepts that underlay the previous banking regime under the convoy system [where all banks were protected from failure as part of a bigger group]. The fact that the convoy system had served the purpose of successfully channelling household savings into the industrial sector, thus supporting the nation’s sustained economic growth, made a rapid shift to the new system more difficult. In other words, the myth that big banks would never fail was so firmly embedded in the economy and society that it took a long time to demolish it.

And even now, it’s far from clear that Japan’s crisis is over. Equities are still far far below their peak in the 1990s (see this Yahoo chart which I won’t embed for copyright reasons). If you’d bought a year or so into Japan’s meltdown – by which time prices had halved, you’d now have seen fifteen years of persistent losses. Share prices recently hit their lowest point since 1982.

So looking forward, we reckon that, first, we’re going see more shocks. Nasty rumours are swirling around Citgroup – a bank Felix Salmon has long argued is ‘too big to rescue’. In the UK, the Tories are hyping up a collapse of the pound. Trouble in emerging markets is surely going to worsen.

Then, it’s going to take a long time for people to understand what need to change – a task made much more difficult by the fact that other unfamiliar pressures are being bought to bear on the global system (this is the main topic of our Bretton Woods paper).

The challenge is to clear up the present mess, while responding to growing resource scarcity, and driving carbon productivity up by ten times or so in a forty year period. Assume that it won’t be easy. And assume that, along the way, some pretty substantial policy failures will compound the market failures we already have.

Addendum: If you haven’t read it, have a look at Michael Lewis’s recent romp through the meltdown – much of it centred on Steve Eisner of Frontpoint partners who was one of the those betting hard on the coming market collapse. It gives you a real sense of how few people really understood what was going on – and how much muck is left to be shovelled out of the stables:

Here he’d been making these side bets with Goldman Sachs and Deutsche Bank on the fate of the BBB tranche without fully understanding why those firms were so eager to make the bets. Now he saw. There weren’t enough Americans with shitty credit taking out loans to satisfy investors’ appetite for the end product. The firms used Eisman’s bet to synthesize more of them. Here, then, was the difference between fantasy finance and fantasy football: When a fantasy player drafts Peyton Manning, he doesn’t create a second Peyton Manning to inflate the league’s stats. But when Eisman bought a credit-default swap, he enabled Deutsche Bank to create another bond identical in every respect but one to the original. The only difference was that there was no actual homebuyer or borrower. The only assets backing the bonds were the side bets Eisman and others made with firms like Goldman Sachs. Eisman, in effect, was paying to Goldman the interest on a subprime mortgage. In fact, there was no mortgage at all.

“They weren’t satisfied getting lots of unqualified borrowers to borrow money to buy a house they couldn’t afford,” Eisman says. “They were creating them out of whole cloth. One hundred times over! That’s why the losses are so much greater than the loans. But that’s when I realized they needed us to keep the machine running. I was like, This is allowed?”